The Ultimate Guide to Business: Leveraging the Expertise of a Tax Attorney

In today’s fast-paced business environment, making informed decisions can mean the difference between success and failure. Whether you're the owner of a small boutique or a large department store, understanding the complexities of tax law is crucial. This is where the invaluable expertise of a tax attorney comes into play. In this guide, we will delve into the myriad ways a tax attorney can empower your business, ensuring that you remain compliant while maximizing your financial performance.

Understanding the Role of a Tax Attorney

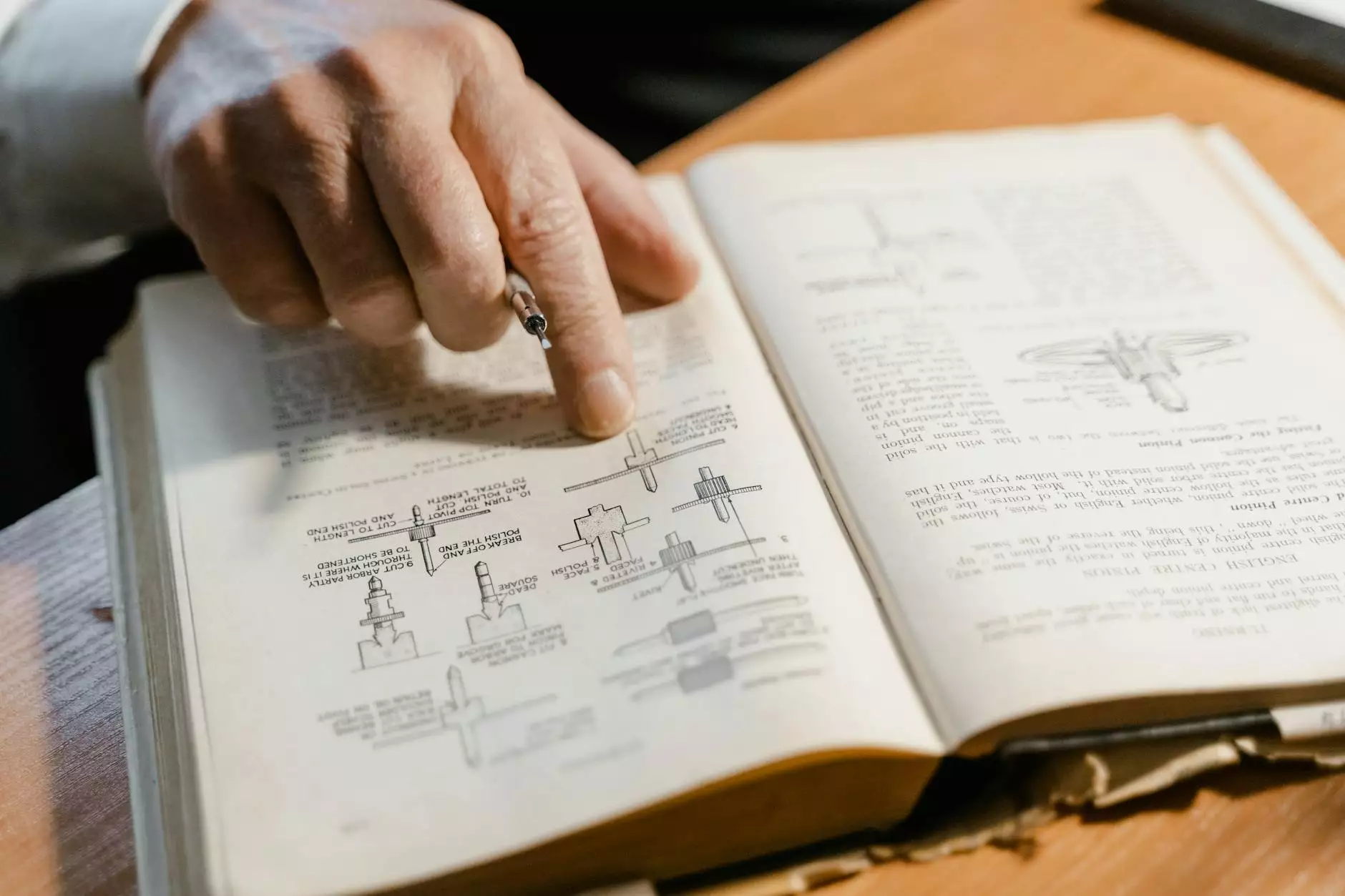

A tax attorney specializes in tax law and offers legal advice to individuals and businesses regarding their tax situation. They navigate the intricacies of the tax code, representing clients in disputes with tax authorities and ensuring that their financial practices align with legal standards. Here’s a closer look at what a tax attorney does:

- Tax Planning: Creating effective tax strategies to minimize liabilities.

- Compliance: Ensuring adherence to federal and state tax laws.

- Representation: Acting on behalf of clients in audits or tax disputes.

- Consultation: Providing guidance on business structures and tax implications of different options.

- Education: Keeping business owners informed of changing tax laws and regulations.

The Importance of Tax Planning for Businesses

Tax planning is a critical component of overall business strategy. By proactively managing your tax obligations, you can optimize your financial resources. Here's how a tax attorney can assist with tax planning:

1. Identifying Tax Deductions and Credits

A tax attorney can help uncover potential deductions and credits that your business may be eligible for, thus reducing taxable income. Common deductions for businesses include:

- Operational expenses (e.g., rent, utilities, supplies)

- Employee wages and benefits

- Depreciation of assets

- Marketing and advertising costs

2. Structured Business Entities

The type of business entity you choose (LLC, Corporation, Sole Proprietorship) can significantly impact your tax obligations. A tax attorney can provide insights into which structure is most beneficial for legal protection and tax efficiency.

3. Minimizing Tax Liability through Tax-deferred Accounts

Establishing and contributing to tax-deferred retirement plans or health savings accounts can effectively lessen your current tax burden. A tax attorney will guide you through options available to help you retain more of your earnings.

Navigating Tax Compliance: A Necessity for Businesses

Staying compliant with tax regulations is essential for avoiding penalties and maintaining credibility. A tax attorney plays a pivotal role in ensuring that your business meets all federal, state, and local tax laws. Here are essential compliance aspects they assist with:

1. Filing Requirements

Different business structures have different filing requirements. A tax attorney ensures that your business meets all necessary deadlines and submits accurate tax returns.

2. Payroll Taxes Compliance

As an employer, you have specific payroll tax responsibilities that must be upheld. A tax attorney can help you accurately calculate and file payroll taxes, thereby avoiding costly errors.

3. Sales Tax Regulation

If you operate a department store or engage in retail, understanding the complexities of sales tax regulations is crucial. A tax attorney can help navigate these regulations to ensure compliance.

Representing Your Business During Tax Disputes

Even with meticulous planning and compliance, disputes with tax authorities can arise. Whether facing an audit or a tax lien, having a tax attorney by your side is invaluable. Their expertise includes:

1. Audit Representation

If your business is selected for an audit, a tax attorney can represent you before the IRS or state tax agency, ensuring that your interests are protected throughout the process.

2. Negotiation of Settlements

Should your business face tax liabilities that it cannot pay, a tax attorney can negotiate with tax authorities to settle on a reasonable payment plan or even a reduced settlement, alleviating undue financial stress.

3. Litigating Tax Issues

In situations where disputes escalate, your tax attorney can represent your case in court, providing a defense grounded in extensive knowledge of tax law.

The Advantage of Staying Informed: Continuous Education in Tax Law

Tax laws are continually evolving. Compliance requires ongoing education, which a tax attorney can provide. They offer insights and updates related to:

- Changes to tax legislation

- Potential implications of new tax rules for your business

- Best practices to implement effective tax-consulting strategies

Conclusion: A Strategic Investment for Business Success

Partnering with a tax attorney is more than just a safety net—it is a strategic investment in your business's future. By leveraging their skills, you can optimize your tax strategies, ensure compliance with the law, and maintain a solid financial footing. In the competitive landscape of today's market, having the right support can set your business apart and lead to long-term prosperity.

To truly excel, embrace the opportunity to engage with a tax attorney who understands your specific business needs. Not only will this ensure your compliance and financial acumen, but it will also allow you to focus on what you do best: running and growing your business.

Contact Information

For more information on how a tax attorney can assist your business, visit kesikli.com to explore resources and professional services tailored to meet your unique needs.